Blog

September Default Rates Up for Most Loan Types

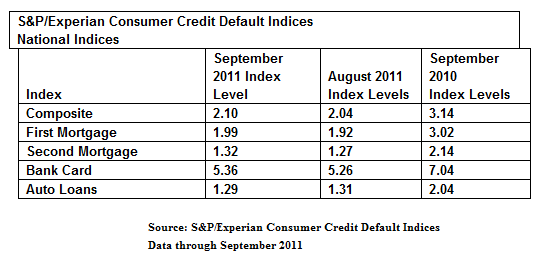

Default levels rose in all creditrncategories except auto loans in September according to data from S&PrnIndices and Experian. The month-to-monthrnchanges represented the first increases in some of the loan indices in morernthan a year. The increases affected fourrnout of five regions tracked by the ratings agencies with the New York regionrnhaving the most dramatic rise, going from 1.80 (all index numbers are expressedrnas a percent) to 2.01.</p

The Composite Index, which includes fourrnloan types, first and second mortgages, credit cards, and auto loans, rose fromrn1.92 percent in August to 1.99 in September. rnIn September 2010 this index was at 3.14. The index measuring first mortgage defaultsrnwent from 1.92 in August to 1.99 in September and was 3.02 a year earlier. Thisrnwas the first increase in this index since November 2010. Second mortgages rosernfrom 1.27 to 1.32 percent compared to 2.14 a year ago. The biggest change was in the bank cardrndefault rate which jumped from 5.26 to 5.36. rnThe default rate a year earlier was 7.04. Defaults in auto loans were down from 1.31 inrnAugust and 2.04 a year ago to 1.29. </p

“While this is onlyrnone month of data, we have not seen so many increases in default rates in aboutrna year or more,” says David M. Blitzer, Managing Director and Chairman of thernIndex Committee for S&P Indices. Given the fragile state of both therneconomy and consumer confidence we will have to closely monitor these data overrnthe next few months to determine if September was just a temporary blip or thernreversal of the recent trend.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment