Blog

Vacant Units Decline but so does Homeownership

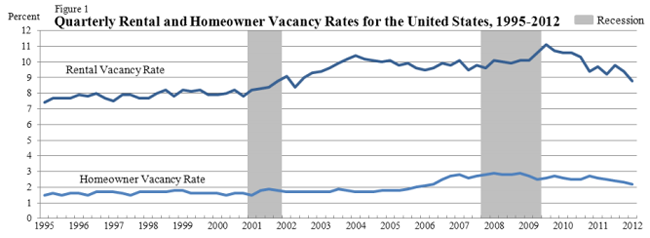

Vacancy rates for both owner-occupied and rental properties dropped to new recent lows in the first quarter of 2012 according to data released by the U.S. Census Bureau on Monday. The rental vacancy rate dropped below 9 percent for the first time since the second quarter of 2002 and the homeowner rate was the lowest since the first quarter of 2006.</p

Rental vacancies were at a rate of 8.8 percent compared to 9.4 percent in the fourth quarter of 2011 and 9.7 percent in the first quarter of 2011. The rate of homeowner vacancies was 2.2 percent compared to 2.3 percent in the previous quarter and 2.6 percent in the first quarter of 2011. This is the lowest that vacancy rate has been since the first quarter of 2006 when it was 2.1 percent.</p

</p

</p

There are an estimated 132.1 million housing units in the U.S., an increase of 486,000 since the first quarter of 2011. Of these, 114,122 are occupied, one million more than a year earlier and 19.0 million are vacant, down just over one -half million. At the same time the number of owner occupied houses also decreased by a half million from 75.1 million in Q1 2011 to 74.6 million.</p

Of vacant housing units 14.4 million or 10.6 percent are considered year-round housing and of those, 4.1 million units are for rent, 2.0 million are for sale and 7.4 million are being held off the market about half for occasional use by the owner or a non-arms length occupant.</p

Homeownership rates declined again in the first quarter consistent with the pattern of most quarters since the rate peaked at 69.0 percent in the third quarter of 2006. The current rate is 65.4 percent, down from 66.0 percent in the fourth quarter and 66.4 percent in the first quarter of 2011. Homeownership declined across all age groups and all ethnic groups covered in the study.</p

</p

</p

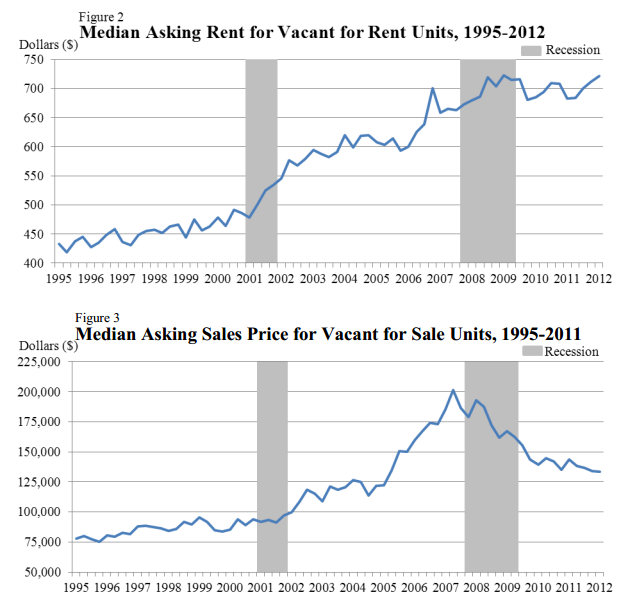

While the declining vacancy rates have been reflected in increasing rental prices, the same is not true for home sale prices. The median asking rent for vacant units in the first quarter was $721, up from $712 in the previous quarter and $683 one year earlier. The median asking sales price for vacant units in the first quarter was $133,700, down from $133,800 in Q4 and $143,700 in Q1.</p

</p

</p

Rental vacancy rates declined in three of the four regions on an annual basis. Only in the Northeast did the rate increase from 6.8 percent in the first quarter of 2011 to 7.8 percent in the first quarter of 2012. In the Midwest the new rate was 9.3 percent compared to 10.2 percent; the South was down from 12.5 percent to ‘10.8 percent and in the West the rate declined from 7.3 percent to 6.3 percent. The rate also declined both inside and outside of Metropolitan Statistical areas.</p

Homeowner vacancy rates declined in all four regions, from 2.2 percent to 1.8 percent in the Northeast, 2.7 percent to 2.1 percent in the Midwest, 2.8 percent to 2.4 percent in the South, and 2.4 percent to 2.0 percent in the West. Homeowner vacancies were down inside MSAs but increased 3 basis points to 2.6 percent outside of MSAs.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment